How Do You Calculate Unlevered Beta

To illustrate the computation of levered beta. Dividing levered beta with this debt effect will give you unlevered beta.

Unlevered Beta Formula Calculator Examples With Excel Template

Unlevered Beta Beta 1 1-Tax Rate DebtEquity The last segment in the formula is the debt-to-equity ratio which shows how the standard beta is adjusted for the amount of debt the firm has.

. βL βU 1 1 - tde Where. Unlevered beta is also known as asset beta because the firms risk without debt is calculated just based on its asset. Therefore based on different levels of debt the debt to equity ratio affects the level of beta thereby increasing leverage.

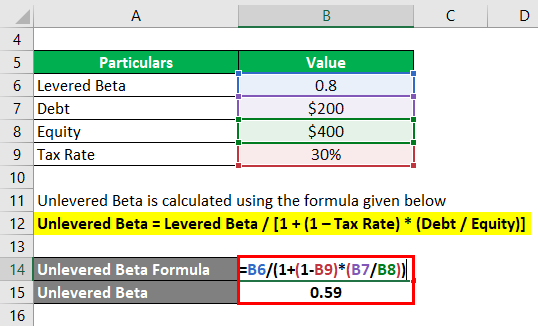

Unlevered beta is calculated as. Levered Beta Formula in Excel with Template Step 1. Press Enter to get the Result.

De is the debt-equity ratio of the company. Insert the formula B4B5 in cell B7 to calculate the debt-equity ratio. Unlevered Beta βCompany A 12 11-03505 091.

As an example of unlevered beta lets assume you have a firm with a beta of 17 and a debt-to-equity ratio of 04. The debt effect can be calculated by multiplying the debt to equity ratio with 1-tax and adding 1 to that value. βL the firms beta with leverage 15 βU the firms beta with no leverage t the corporate tax rate 40 de the firms debtequity ratio 3565.

Unlevered Beta can be calculated using the following formula Beta Unlevered Beta levered 1 1-tax DebtEquity As an example let us find out the Unlevered Beta for MakeMyTrip. It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. How do you calculate a risk scaler.

Equity beta by a multiplier of 1. Unlevered beta is calculated by dividing the observed beta by. What is unlevered beta formula.

Who are the experts. We review their content and use your feedback to keep the quality high. The weights of each project Unlevered Beta Levered Beta Revenues from projects T-Bill SP 500 Debt to Equity ratio.

Unlevered Beta βa Levered Beta βe1 1-Tax RateDebtEquity DE Ratio To calculate the unlevered beta of a company the debt effect has to be removed from the levered beta the debt effect can be computed by multiplying the DE ratio by 1- Tax Rate and thereafter adding 1 to this value. This is multiplied by one of 1 tax rate and the ratio of debt-to-equity of the business. By doing this you eliminate the effect of debt on the capital structure of the company.

Yes when you just take average beta you will get the levered beta. Formula for Unlevered Beta Unlevered beta or asset beta can be found by removing the debt effect from the levered beta. For example using a tax rate of 35 percent debt of 5 million and equity of 10 million unlevering a beta of 10 requires the following calculation.

It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. The given information I have is. Unlevered beta formula could be determined by dividing the levered Beta aka.

Unlevered Free Cash Flow is used in. How Do You Calculate Unlevered Beta Asset Beta. Formula to calculate unlevered beta.

Click to see full answer Likewise how do you calculate Relever beta. The last step is to adjust Company As comparable company unlevered beta for the capital structure of Company X. Unlevered beta asset beta Levered beta equity beta 1 1 tax rate Debt Equity textUnlevered beta asset beta frac textLevered beta equity beta left 1.

The formula to calculate unlevered beta is βL βU 1 1 - t de T is tax rate of the company. To do this look up the beta for a group of comparable companies within the same industry un-lever each one take the median of the set and then re-lever it based on your companys capital structure. We first need to calculate the debt-equity ratio.

Let us take the example of a company named JKL Inc. Unlevered beta is known as asset beta while the levered beta is known as equity beta. To determine the risk of a company without debt we need to un-lever the beta ie remove the debt impact.

Unlevered beta Levered beta 1 1 -. Jun 28 2013 1013 AM. Find Company Xs Unlevered Beta by Adjusting Company As comparable company unlevered beta for the capital structure of Company X.

10 divided by 11-035 multiplied by 5 million10 million or 101 065 multiplied by 50 percent which equals 075. Insert the formula 1 1-B6B7 in. Levered Beta Formula Example 1.

11 minus the tax rate multiplied by debtequity. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Unlevered Beta Levered Beta 1 1 Tax Rate Debt Equity.

Mathematically its represented as. Beta 1 1 tax rate x debt equity 125 1 1 35 x 13 133unlevered beta 1 1-t DebtEquity 133 x 1 1-35 x 13 145. Experts are tested by Chegg as specialists in their subject area.

Unlevered Beta Formula Calculator Examples With Excel Template

No comments for "How Do You Calculate Unlevered Beta"

Post a Comment